Budgeting For Parents

T he panic of having to be responsible for a baby is normal. Becoming a parent to even one child does cause a huge change in finances for years to come. The ride can be rough, however, being flexible and prepared helps in staying calm.

Being able to allocate funds to all the necessities can be made easier, with the help of a budget calculator and allocating funds in advance before the bills start to arrive.

Budgeting For A Baby

Various studies have shown that within a year of having a child, parents have spent over $21,000 on raising the said child. The cost of raising a child to adulthood is not included in this. Expenses do change after having a baby, but this does not mean that the budgeting plan has to change. The income is still being stretched over expenses, debts, and savings.

The most common way to split an income is with the 50/ 30/ 30 approach

- 50% goes on the house bills which includes loan payments, child care, diapers, and formula

- 30% goes to paying loans such as credit card bills

- 30% goes to financial wants such as insurance, rent, transport, food, gas & electricity.

Use a 50/ 30/ 30 split on the income to create a baseline for spending, and track month to month to see how it goes.

Building The Baby Budget In Easy 4 Steps

1. Outline The Financial Properties

Sure, saving a child’s education is necessary; however, this does not mean the current and future savings should be sacrificed. After all, loans can be taken for education, but never for retirement.

After having an emergency fund, or money for a rainy day set aside, the financial responsibilities should be

- Contributing to an emergency fund. Once a base has been built, the next focus is being able to save up enough equal to the income of several months.

- Paying off debts such as credit card debt, loans, and money to be used during the month.

- Retirement savings are crucial for everyone. Ideally, 15% of the income every month should be set aside to save enough to live on, once retired. Find out at the company, if after a certain amount has been saved, does it offer to match on the 401k.

Once progress has been made on these things, then one can think about saving for college or any other education.

2. Living On Less

Income can change once the baby arrives. A parent goes on maternity leave, or at times decides to stop working altogether.

This will lead to a massive shift in the money coming in every month. Practice by living on one person’s income leading up to the time of the baby’s arrival, setting aside that unused income to help prepare for the upcoming expenses. This will help to get accustomed to living on less or being able to budget money in a way where more savings than realized can be made.

3. Prepare For Expenses To Change

The cost of raising a child changes often as expenses shift. After all, diapers will not be used forever. The money will end up being needed for the child’s insurance or soccer lessons or even getting an extra person onto the auto plan.

Reduce the costs by buying things secondhand or by requesting must-have items at the baby shower that will take place.

Whereas, some expenses are temporary such as child care ends once a child starts going to school or starts working.

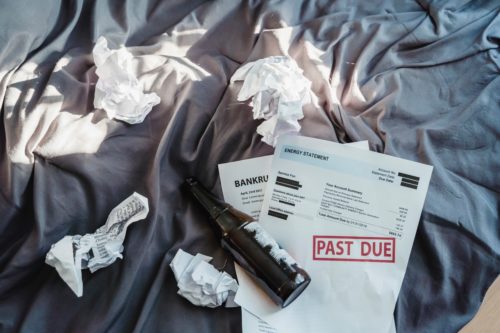

4. Prepare For Emergencies

Even though there are many one-time costs on new parents such as cribs, prepare mentally and financially to dip into the emergency funds that have been set aside. There are times when there just isn’t enough money in the bank accounts. Cutting expenses can become crucial as the days go by.

Find new ways to make a little cash on the side of working a full-time job. See if getting a raise, or a job with better pay is possible. Cancel unused subscriptions to magazines and streaming services.

Look around for better deals on the multiple insurances where the bills continue building up; see what can be reduced.

Budgeting with children can seem tough, but it does help to remember that just like how some of these expenses are temporary, the sacrifices made for having a child will be temporary as well. Budgeting for parents is easy if you communicate as partners and make smart decisions.